92

NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

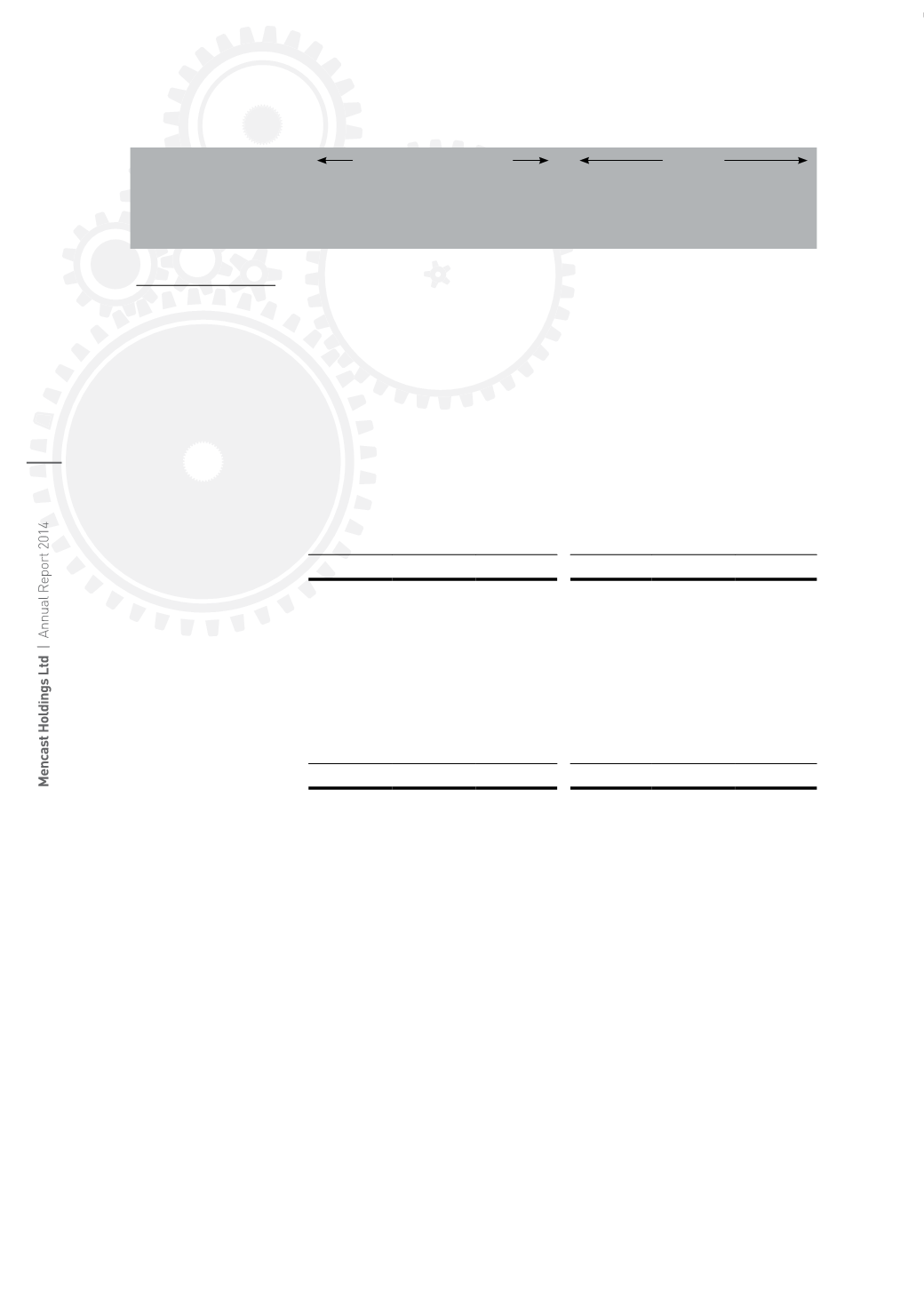

24.

Share capital and treasury shares

No. of ordinary shares

Amount

Issued

share

capital

Treasury

shares

Total

Share

capital

Treasury

shares

Total

‘000

‘000

‘000

$’000

$‘000

$‘000

Group and Company

2014

Beginning of

financial year

293,916

(250) 293,666

58,576

(135)

58,441

Shares issued

3,231

–

3,231

1,850

–

1,850

Bonus shares

808

–

808

–

–

–

Issue of new shares

pursuant to rights

issue

59,541

– 59,541

11,800

– 11,800

Award of performance

shares to employees

–

144

144

(6)

78

72

Purchase of

treasury shares

–

(299)

(299)

–

(136)

(136)

End of financial year

357,496

(405) 357,091

72,220

(193)

72,027

2013

Beginning of

financial year

226,025

– 226,025

53,976

– 53,976

Shares issued

10,945

– 10,945

4,600

–

4,600

Bonus shares

56,946

– 56,946

–

–

–

Purchase of

treasury shares

–

(250)

(250)

-

(135)

(135)

End of financial year

293,916

(250)

293,666

58,576

(135)

58,441

All issued ordinary shares are fully paid. There is no par value for these ordinary shares.

Fully paid ordinary shares carry one vote per share and carry a right to dividends as and when

declared by the Company.

On 19 February 2014, the Company issued and allotted 2,200,704 new ordinary shares (as adjusted

to take into account the Bonus Issue shares of 440,140) in the capital of the Company for total

consideration of $1,000,000 as 3rd tranche consideration shares pursuant to acquisition of the

business of Team.

On 9 May 2014, the Company issued and allotted 1,838,235 new ordinary shares (as adjusted to take

into account the Bonus Issue shares of 367,647) in the capital of the Company for total consideration

of $850,000 as 2nd tranche consideration shares pursuant to acquisition of Vac-Tech.

On 17 July 2014, the Company completed its Rights Issue through allotment and issuance

of 59,540,977 new ordinary shares at $0.20 for each rights share for a total consideration of

$11,800,000.

All the newly shares issued during the year rank

pari passu

in all respects with the previously

issued shares.