100

NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

28.

Financial risk management

(continued)

(b)

Credit risk

(continued)

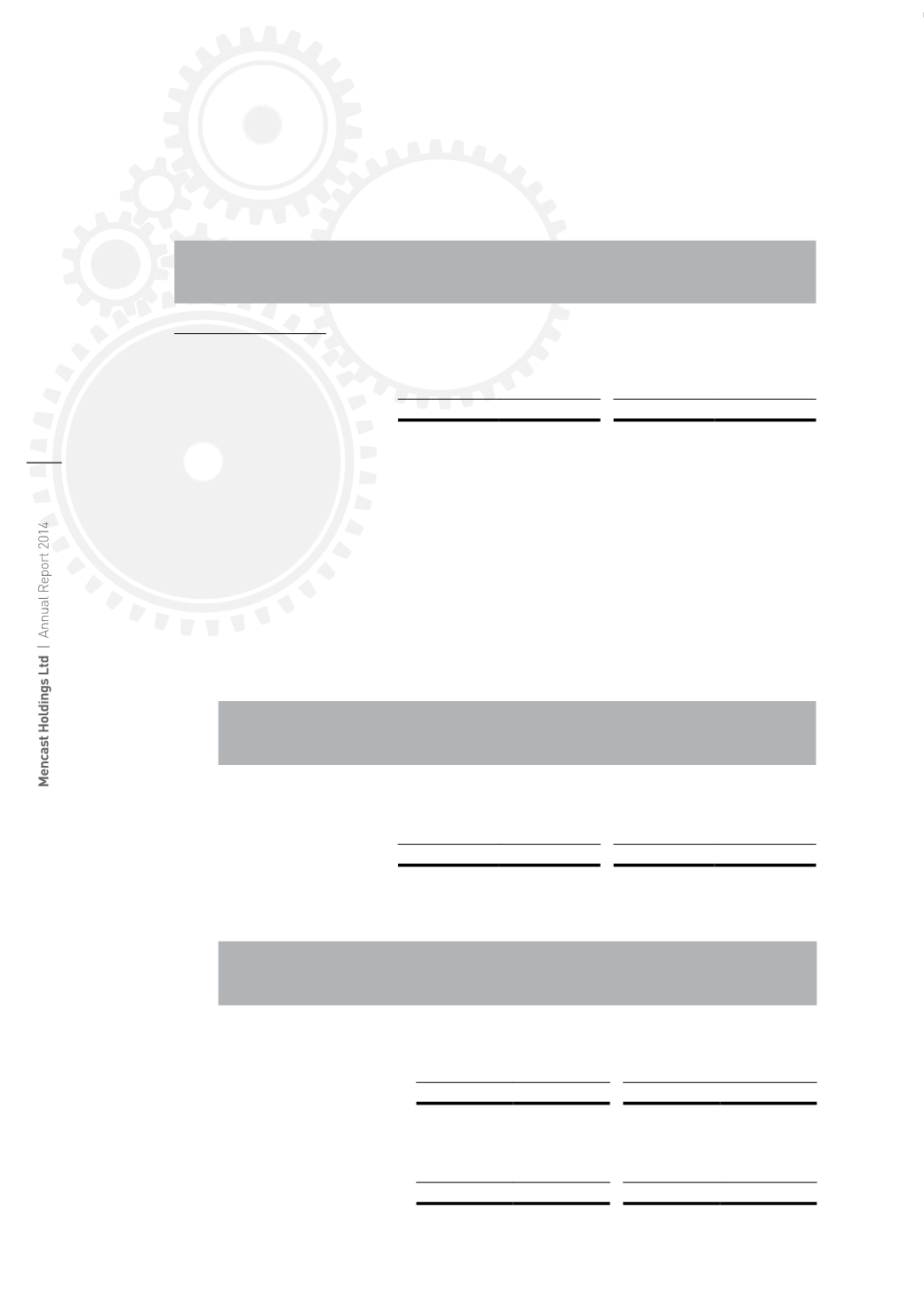

The credit risk for trade receivables based on the information provided to key management is

as follows:

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

By types of customers

Non-related parties

- Multi-national companies

14,510

11,299

–

–

- Other companies

33,380

15,756

–

–

47,890

27,055

–

–

(i)

Financial assets that are neither past due nor impaired

Bank deposits that are neither past due nor impaired are mainly deposits with banks

with high credit-ratings assigned by international credit-rating agencies. Trade

receivables that are neither past due nor impaired are substantially from companies

with a good collection track record with the Group.

(ii)

Financial assets that are past due and/or impaired

There is no other class of financial assets that is past due and/or impaired except for

trade receivables.

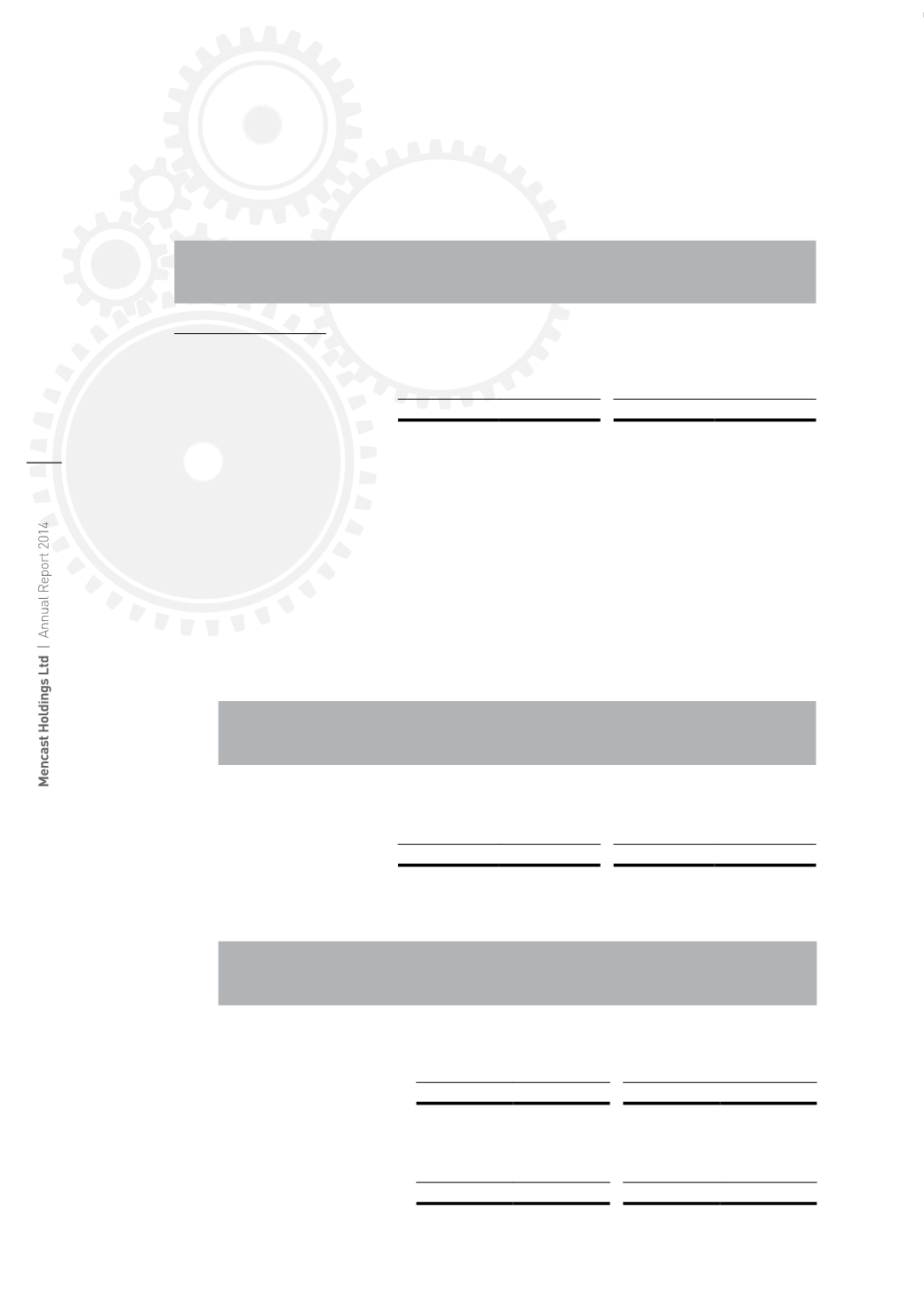

The age analysis of trade receivables past due but not impaired is as follows:

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Past due <3 months

20,796

11,768

–

–

Past due 3 to 6 months

10,070

4,048

–

–

Past due over 6 months

12,754

2,733

–

–

43,620

18,549

–

–

The carrying amount of trade receivables individually determined to be impaired and

the movements in the related allowance for impairment are as follows:

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Gross amount

2,538

1,687

–

–

Less: Allowance for

impairment

(1,851)

(1,252)

–

–

687

435

–

–

Beginning of financial year

1,252

1,158

–

–

Allowance made

986

169

–

–

Write-back of allowance

(387)

(75)

–

–

End of financial year

1,851

1,252

–

–

The impaired trade receivables are mainly from sales to customer which has suffered

significant losses in its operations