83

NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

18.

Property, plant and equipment

(continued)

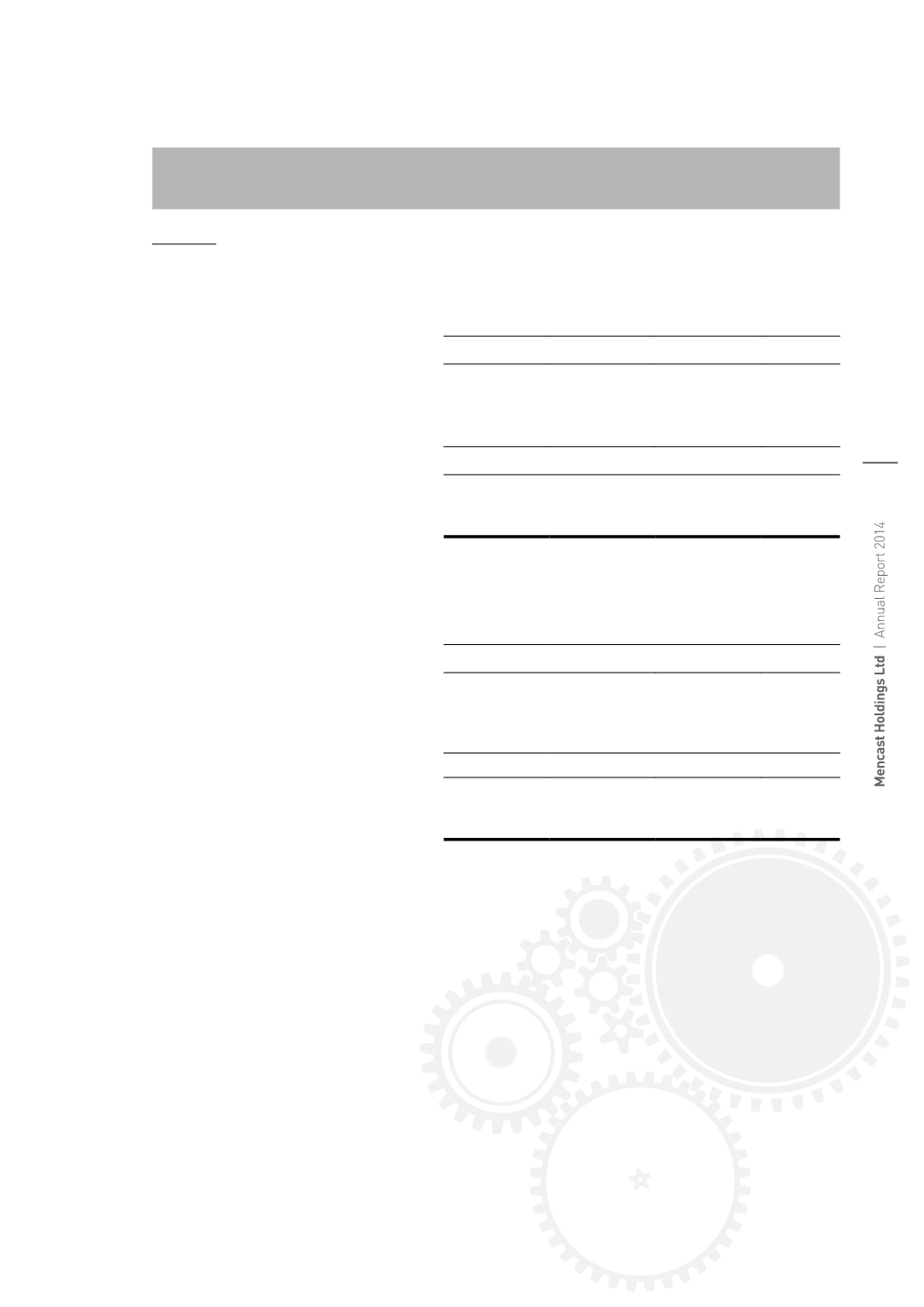

Office

Equipment

Computers Renovation Total

$’000

$’000

$’000

$’000

Company

2014

Cost

Beginning of financial year

1

38

24

63

Additions

1

46

–

47

End of financial year

2

84

24

110

Accumulated depreciation

Beginning of financial year

–

12

5

17

Depreciation charge

–

25

5

30

End of financial year

–

37

10

47

Net book value

End of financial year

2

47

14

63

2013

Cost

Beginning of financial year

–

26

22

48

Additions

1

12

2

15

End of financial year

1

38

24

63

Accumulated depreciation

Beginning of financial year

–

2

–

2

Depreciation charge

–

10

5

15

End of financial year

–

12

5

17

Net book value

End of financial year

1

26

19

46

Additions during the financial year included machinery and equipment and motor vehicles acquired

under finance leases amounting to $2,888,000 (2013: $12,947,000).

Building on leasehold land and construction in progress under construction loan amounting to

$27,232,000 (2013: $7,762,000)

The carrying amounts of machinery and equipment and motor vehicles held under finance leases

are $26,522,000 (2013: $26,678,000) at the balance sheet date.

Certain bank borrowings are secured by buildings on leasehold land of the Group with carrying

amounts of $66,685,000 (2013: $76,272,000) (Note 21).