73

NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

10.

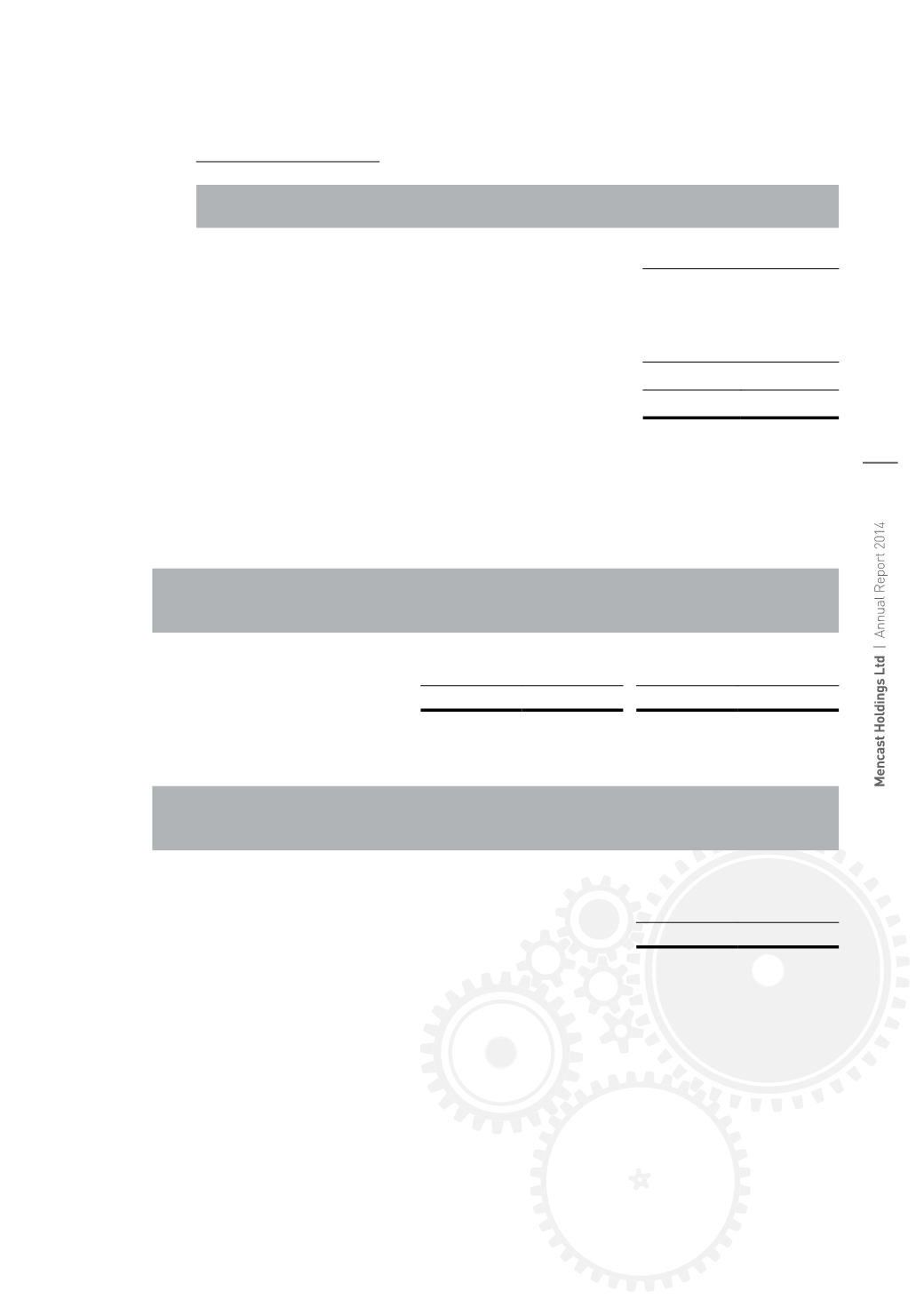

Earnings per share

(continued)

(b)

Diluted earnings per share (continued)

Group

2014

2013

Net profit attributable to equity holders of the Company ($’000)

17,460

15,721

Weighted average number of ordinary shares outstanding for

basic earnings per share (’000)

345,320

330,029

Adjustment for

- Performance Share Award

58

–

345,378

330,029

Diluted earnings per share (cents per share)

5.06

4.76

For comparative purposes, the weighted average number of ordinary shares outstanding have been

adjusted for the effect of the bonus element of 39,319,513 shares in relation to the rights issue

completed on 16 July 2014 (Note 24).

11.

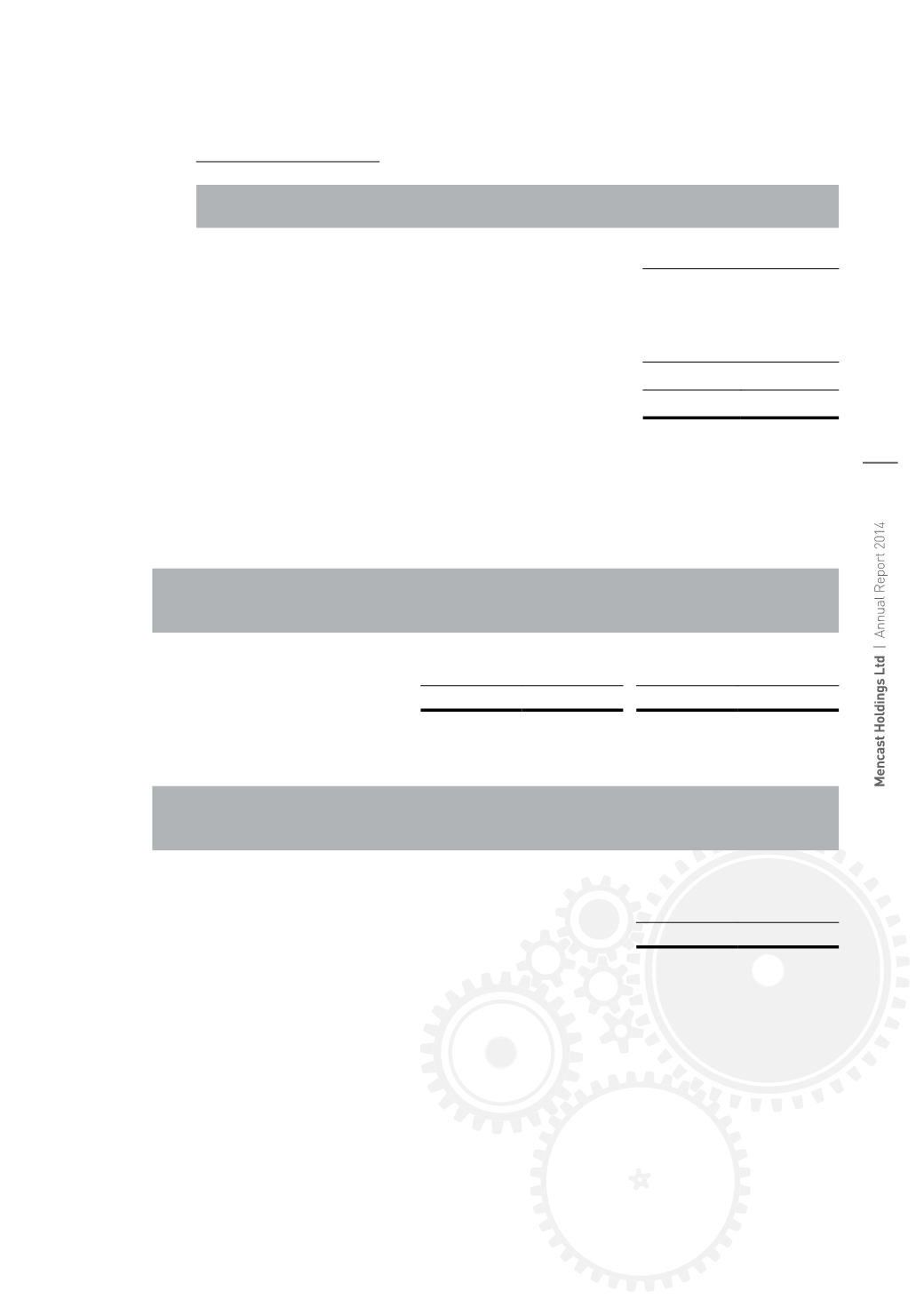

Cash and cash equivalents

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Cash at bank and on hand

16,197

17,420

259

8,947

Short-term bank deposits

3,489

5,249

–

4,021

19,686

22,669

259

12,968

For the purpose of presenting the consolidated statement of cash flows, cash and cash equivalents

comprise the following:

Group

2014

2013

$’000

$’000

Cash and bank balances (as above)

19,686

22,669

Less : Short-term bank deposits pledged

(3,035)

(4,944)

Less : Bank overdrafts (Note 21)

(2,481)

(3,203)

Cash and cash equivalents per consolidated statement of cash flows

14,170

14,522

Certain short-term bank deposits are pledged to secure certain bank borrowings (Note 21).

Please refer to Note 31 for the effects of acquisitions of subsidiaries on the cash flows of the Group

in prior financial year.