71

NOTES TO THE FINANCIAL STATEMENTS

For the financial year ended 31 December 2014

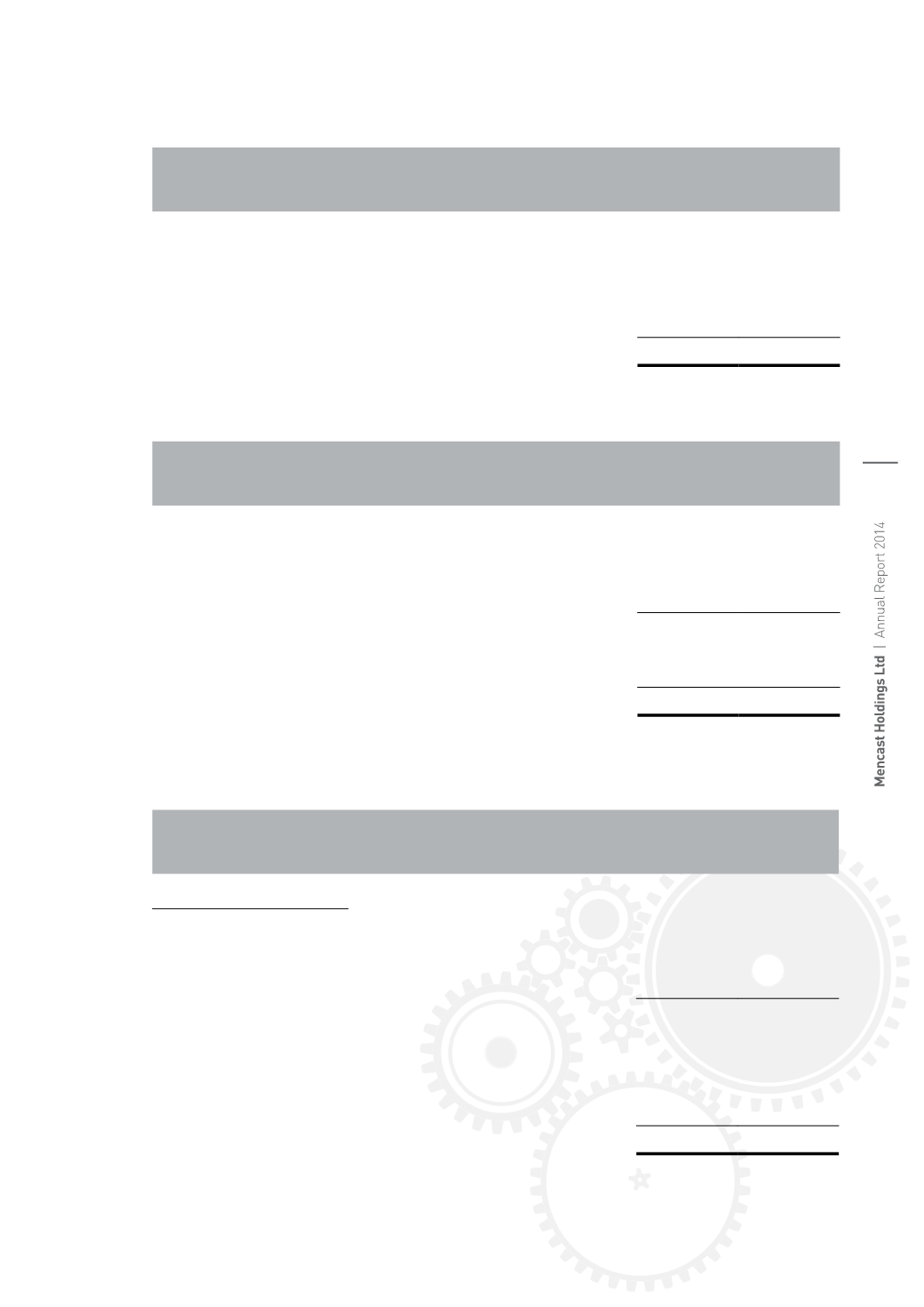

7.

Employee compensation

Group

2014

2013

$’000

$’000

Wages and salaries

31,060

22,877

Employers’ contribution to defined contribution plans

including Central Provident Fund

4,179

3,042

Other short-term benefits

391

450

Performance shares expense

72

–

35,702

26,369

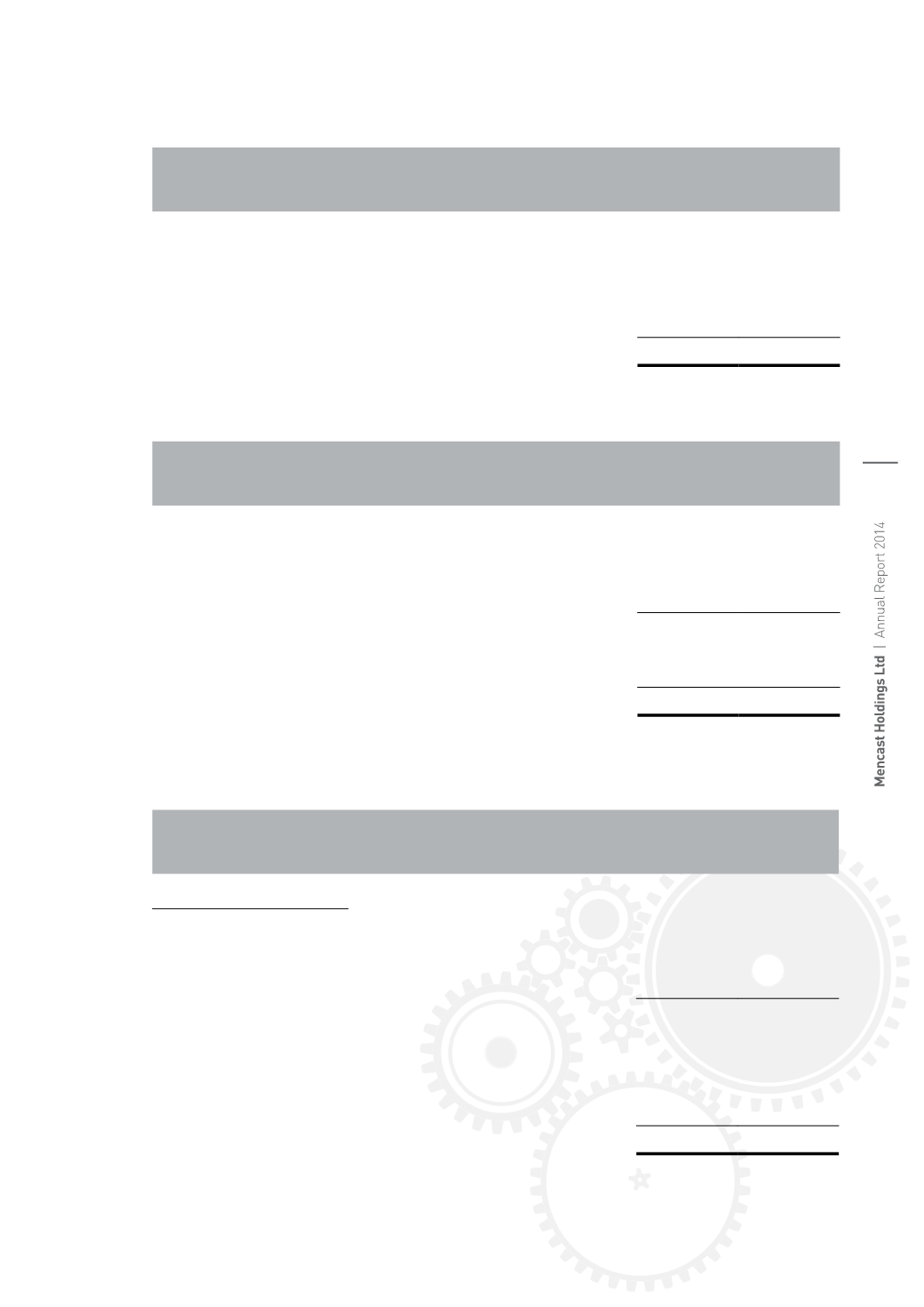

8.

Finance expenses

Group

2014

2013

$’000

$’000

Interest expense on:

- Bank borrowings

1,970

1,229

- Finance lease liabilities

541

321

- Series 1 Notes (Note 21)

3,101

920

5,612

2,470

Less: Borrowing costs capitalised in and

property plant and equipment

(417)

–

5,195

2,470

Borrowing costs on general financing were capitalised at a rate of 5.75% per annum (2013: Nil).

9.

Income taxes

Group

2014

2013

$’000

$’000

Income tax expenses/(credit)

Tax expense/(credit) attributable to profit is made up of:

Profit from current financial year

- Current income tax – Singapore

279

499

- Deferred income tax (Note 23)

1,776

(1,061)

2,055

(562)

Under/(over) provision in prior financial years

- Current income tax – Singapore

124

(276)

- Current income tax – Malaysia

16

–

- Deferred income tax

(461)

1,513

1,734

675